Velocity of Money

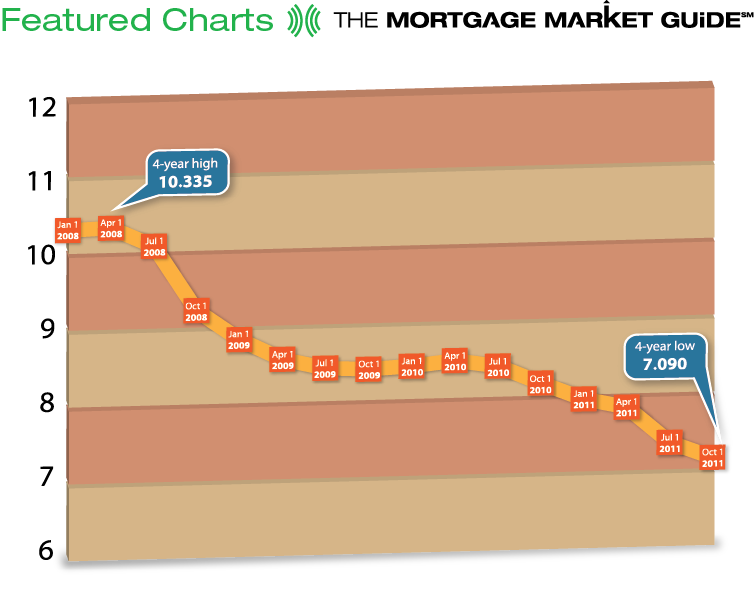

Since the early part of the recession in 2008, the Velocity of Money (M1) has dropped over 30%. Velocity measures how fast money changes hands within the economy. Having it slow significantly while the Fed boosts the M1 money supply suggests that added liquidity is not spurring economic activity or inflation...at least not yet.

Velocity is important for measuring the rate at which money in circulation is used for purchasing goods and services. Higher velocity means the same quantity of money is used for a greater number of transactions and is related to the demand for money. This data can help investors determine how healthy the economy is.

©2012 MSS, LLC. All rights reserved.